Audit for local councils

Welcome to our information page to help Suffolk local councils understand and prepare for their annual audit.

Why audit?

A local council has a range of statutory powers including the authority to raise money through the precept (taxation). This is public money and there are rules and procedures set out in legislation by government to protect the local council and any community assets to ensure there are no unacceptable risks.

In practice this means that Councils must have an adequate and effective financial management framework and sound systems for internal control. To do so local councils must conduct an annual review and approve an annual governance statement in relation to their accounts. To achieve this there is a dual system of independent annual audit - internal and external audit.

How does this work in practice

Local councils are subject to a "light touch" system of external audit, referred to as a "limited assurance review" and the process is different depending on the council's annual turnover. Councils complete an Annual Governance and Accountability Return (often referred to as the AGAR).

The annual audit process also requires the council to advertise the availability of its accounts and supporting documents for inspection for a 6 week period, which must include the first ten working days of July by "interested persons" which are usually local electors. During this period they can ask questions about the accounts for that year and raise an objection with the external auditor.

The public have a right to inspect the accounts during the period advertised.

If everything is in order the council will receive a signed certificate from the external auditor and an "unqualified opinion" on the AGAR. This means that nothing has come to the external auditor's attention that gives cause for concern. Only a significant problem would cause the external auditor to "qualify" the accounts and this is a serious issue that needs to be addressed.

Finally, the council then has to publish a notice stating that the audit has been completed, publish and display its AGAR by no later than 30th September.

How should councils prepare?

We have produced a short video to help councils prepare which contains good practice and some tips following issues and trends identified by our internal auditors from their experience of working with Suffolk councils. This information is also available for you to download as a pdf, click on this link to download.

This is a good place to start - even for an experienced clerk or RFO as it provides some tips to help you manage this important annual process for your council. Additionally, take time to familiarise yourself with the Governance and Accountability, Practitioners' Guide. Click on this link to go to the SAAA website.

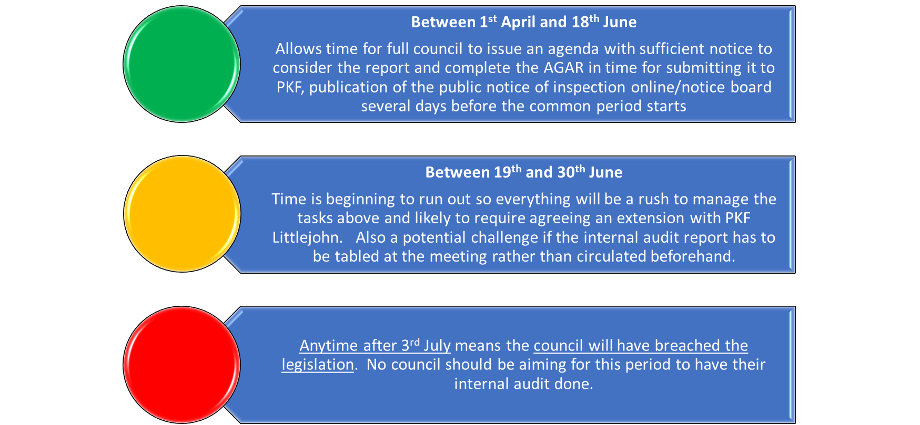

We also recommend that your council carefully considers the timing of the internal audit. If this is left too late then there are risks you need to be aware of. The visual guide below explains this further and the consequences.

FAQs

We have put together some helpful information based on frequently asked questions we regularly receive on this topic. If you wish to raise anything further with us - either use the portal enquiry function or give us a call and we will do our best to assist. We will continue to add more guidance to this page where necessary.

SAAA stands for Smaller Authorities' Audit Appointments and are the sector-led limited company appointed as the specified person to, amongst other things, procure and appoint external auditors to smaller authorities in England. They are a not-for-profit company limited by guarantee and were set up in 2015 by the Department of Communities and Local Government (DCLG).

Smaller Authorities include town and parish councils and parish meetings. As previously explained the external audit process is referred to as "limited assurance" and varies according to the size of the authority.

More information can be found on their website accessible using this link.

The Practitioner's Guide provides information on the proper practices to be applied in the preparation of statutory annual accounts and governance statements. It is revised every year. The current edition is dated 2025 - here is a link to the SAAA website where it can be downloaded. This linked page includes access to the legislation governing audit.

The Practitioners’ Guide (‘the guide’) is designed to support the preparation by smaller authorities of statutory annual accounting and governance statements found in the Annual Governance and Accountability Return ("AGAR").

Sections 1,2 and 3 of the guide represents the proper accounting and governance practices ("proper practices) referred to in statute. They set out for responsible financial officers the appropriate standard of financial and governance reporting for smaller authorities and are mandatory. Although a parish meeting is a relevant authority, there are some circumstances where legislative requirements differ. As a result proper practices set out in the guide apply differently to parish meetings and separate AGARS (suffixed PM) have been produced for that purpose.

Section 4 of the guide sets out the non-statutory best practice guidance relating to internal audit which authorities are required to consider. Section 5 of the guide provides supporting information and practical examples to assist smaller authority officers to manage their governance and financial affairs and is not mandatory.

The guide is intended as a working tool for smaller authorities, providing not only the common ‘rules’ for completing an Annual Governance and Accountability Return for use by responsible financial officers, but also as a reference work for auditors, both internal and external, councillors, other officers, and the public to aid understanding of the Annual Governance and Accountability Return and the reporting on the smaller authority’s governance and finances within it.

The SAAA website publishes details of the process including what happens if you miss deadlines. Use this link to visit the dedicated page on their website.

The SAAA website publishes details of appointments including the one for Suffolk. Use this link to visit the dedicated page on their website.

Sometimes SALC is informed when the information packs are being sent to Suffolk councils but this is not guaranteed. In the past these are distributed from the middle of March.

The SAAA website publishes details of fixed fees. Use this link to visit the dedicated page on their website.

We can only provide details of the SALC internal audit service although there are others available - here is a link to information we have published on our website.

Yes - local electors have rights to inspect and ask the auditor questions about the accounts and object to them. When the authority has finished preparing its accounts for the financial year, they must make them available for inspection. There must be a 30 working-day period, called the inspection period, during which there is a statutory right to inspect the accounts. There is more information on the SAAA website. Use this link to visit the dedicated page on their website. See above - our RAG rating to help your council manage this timeline.

The appointed external auditor, under the Local Audit and Accountability Act 2014, has a duty to consider whether to issue a report in the public interest when a significant matter comes to their attention which they believe the council should consider or the public should know about. There is more information on the SAAA website - use this link to access their dedicated page on this subject.

Section 4 of the Practitioner's Guide provides comprehensive guidance on internal audit. Smaller authorities are required by the Accounts and Audit Regulations 2015 to ‘undertake an effective internal audit to evaluate the effectiveness of its risk management, control and governance processes, taking into account public sector internal auditing standards or guidance’. It includes guidance on the selection process for appointing an internal auditor. Here is a link to the SAAA website and their page where the Practitioner's Guide can be downloaded for further reference.

SALC has service level agreements set up with six internal auditors giving us the capacity to undertake up to 150 internal audits per annum. If you are an existing customer of SALC (eg you used us last year) we will contact your clerk to inform them of the booking process and when our internal audit service starts and finishes. We are also a member of the Internal Auditor Forum.

We have a procedure that helps us manage the process and within that it stipulates how we select individuals to work with us to deliver the service including standards on their knowledge and expertise. Our templates and checklists are reviewed annually as is the process so that we refine and improve continually. Our templates are aligned to the Practitioner's Guide including good practice so that our reports are comprehensive and add value to the council. Trends that we notice from this service feeds back into the SALC workplan so that we look at ways we can address common issues through our communications, training and networking.

Apart from large town councils, where we offer a site visit, our internal audit service is fully electronic.

If you have not used the SALC internal audit service before please visit our dedicated page on this website using this link so that you can complete an enquiry form and see what our fees are for the current financial year.

These have now been published and available from the SALC portal to download including guidance notes.

-

At the January 2024 clerk networking event our Advice Manager ran a short workshop focussing on the Transparency Code and Publication Scheme as we had identified a lack of understanding on these topics.

-

This new information page is part of our campaign to raise awareness of the components of audit.

-

At the February 2024 clerk networking event one of our experienced internal auditors will be available for questions.

-

We have refreshed our preparing for audit video to reflect issues and trends from the previous year.

-

We will be publishing blogs - such as this one about the merits of .gov.uk domains.

-

Our digital e-magazine, the TLC due out in February, will also feature the importance of audit and a case study on the experience of moving to a .gov.uk domain and emails.

-

In the autumn we will reflect on whether this additional support has made a difference ready for next year and feed this into our review of processes and procedures.

A Parish Council Domains Helper Service has been set up by the Cabinet Office to help councils move to .gov.uk domains. We have written a useful news blog on this topic which can be accessed here.

Details about processes for completing the AGAR can be found on the SAAA website - use this link to visit a dedicated page. This includes forms 1 to 3 that reflect different levels of financial turnover. When PKF LittleJohn send information to your council their supporting documentation should provide a full explanation.

No, both the income and expenditure have to be £25,000 or below. This is one of the required criteria needed to claim exemption. click on this link to view all criteria on the PKF Littlejohn website.

Yes, a council must ensure it has an annual internal audit carried out